Liner operators pursue diverging approaches to alternative fuels

Liner operators pursue diverging approaches to alternative fuels

Liner operators are taking a proactive approach to decarbonisation that includes the evaluation and selection of alternative fuels to power their fleets. How do their strategies differ and what are the implications?

The liner sector is under increasing pressure to decarbonise, with environmental improvements coming to bear through increasingly stringent greenhouse gas (GHG) reduction regulations, as well as new and emerging ESG requirements from shippers and consumers. More energy efficient engines and slow steaming have already enabled the container fleet to achieve efficiency gains. However, these measures alone are not sufficient to meet IMO’s long-term GHG reduction ambitions, with the Fourth IMO GHG Study stating that a large share of the total amount of CO2 reductions from shipping in 2050 will have to come from low carbon alternative fuels.

Alternative fuel options for the container fleet

Examples of alternative fuels that liner shipping companies are evaluating include ammonia, biofuel, and methanol (variable carbon intensity depending on feedstock and production pathway used). Technical and regulatory maturity varies across each option, while standard pricing models and global availability remain largely unknown factors. Some liner management teams also consider LNG to be a “bridge” or “transition” low carbon fuel, which offers a mature solution that can be utilised (despite current issues with methane leakage) until other options become more widely available.

Unless the option selected can be utilised as a “drop in fuel” (compatible with existing engines), alternative fuels will be introduced to the global shipping industry through fleet renewal or appropriate retrofitting. This requires significant investment, planning and new risk exposures. Ship owners across many segments are assessing what viable routes are available to transition their fleets to alternative fuels. However, the transition is perceived to be accelerated in the liner market, due to its proximity with global consumers and their increasingly stringent environmental preferences. As a result, liner owners and operators are now increasingly placing orders for new ships that can be powered by alternative fuels. Some are also funding research, taking equity positions in businesses engaged in alternative fuels and/or decarbonisation, and forging collaborations with new energy suppliers and industry peers. In a recent example, Maersk and CMA CGM announced a new partnership to develop the use of alternative greener fuels for vessel propulsion. Their aims include working towards the development of mass production of both green methane and methanol, bunkering solutions at global ports, and potential R&D solutions for fuels such as ammonia and ship technology.

Global container orderbook status

In September 2023, the global container orderbook totalled about 915 ships, with an operating capacity of circa 7.7m TEU. Of these orders, about 50% of vessels include an alternative fuel specification, with current choices appearing to include LNG, methanol and to a lesser extent, ammonia.

According to shipping databases, many of these ships are classified as being, “dual fuel”, or “ready” to run on an alternative fuel:

- "Ready": Though exact definitions can vary, “ready” broadly describes a ship that can run on an alternative fuel after a conversion process. This could involve retrofitting with a new engine specification or the removal of container slots to insert an LNG fuel tank. Conversion costs are variable. In 2020 Hapag-Lloyd group retrofitted an “LNG ready” container ship so it could be fuelled by LNG. A tank weighing 1,300 tonnes was fitted to the vessel to complete the conversion, at an overall cost said to be circa USD 35m. At the time, Hapag-Lloyd group maintained that future conversions would be cost-prohibitive.

- "Dual Fuel": A ship that can be operated with an alternative fuel, or conventional VLSFO with no additional costs for conversion or retrofitting of equipment. Dual fuel ships are sometimes referred to as “capable”.

So what choices have liner operators made to date?

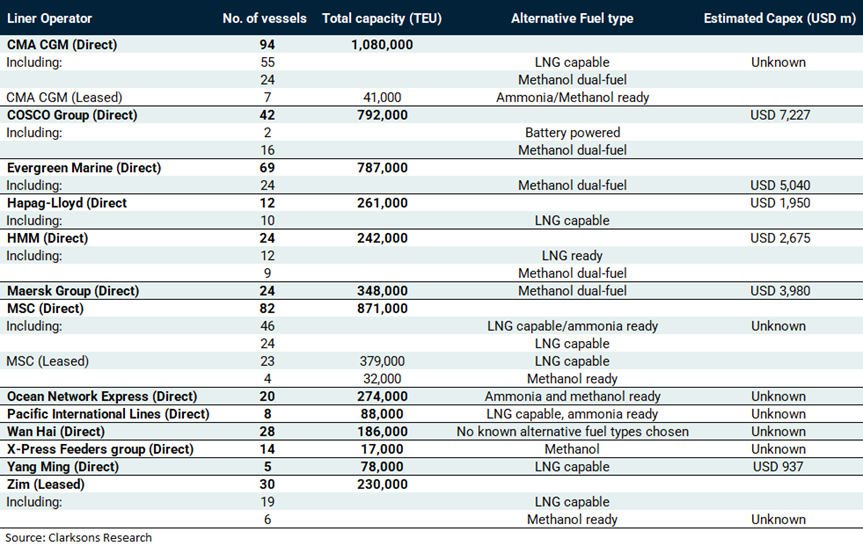

Orderbook of major liner operators (September 2023)

What alternative fuels have key players* adopted so far?

Maersk group is understood to have committed to methanol as its primary alternative fuel choice, with 24 vessels on order, ranging from 9,000 TEU to 17,000 TEU capacity. Its first green methanol dual-fuel vessel (also classified by Maersk as a methanol-enabled unit), the 2,100 TEU capacity mv Laura Maersk, was delivered to the fleet in July 2023. Maersk group is also taking tangible steps to support the emerging methanol supply chain through new investments and commercial agreements with several suppliers. Notwithstanding this, the group’s orderbook is currently small when compared to some of its main peers.

MSC group is in the middle of a fleet renewal programme that includes around 100 dual-fuelled vessels for delivery between 2H 2023 and the end of 2026; these vessels are primarily focused on LNG and methanol. In addition to ordering units for its direct account, MSC group is also long-term leasing a number of vessels (based on alternative fuels). The cost of the group’s fleet renewal remains unknown since limited information has been released regarding its newbuilding strategy; however, a conservative estimate could place this in the region of about USD 10bn.

CMA CGM group is operating nine vessels of 23,000 TEU on LNG and has a further 55 LNG-capable units that are due for delivery. In a proactive move, a deal was signed with TotalEnergies SE group in late 2017 to supply about 300,000 tonnes of LNG per year until 2030. In addition, CMA CGM group is also looking towards the utilisation of methanol dual-fuel vessels, with 24 ships on order.

Taiwan’s Evergreen Line has the third largest orderbook, currently numbering 69 vessels, which has recently increased after an order for 24 x 16,000 TEU methanol dual-fuel units placed with two Asian shipyards; the reported cost of these 24 units alone is about USD 5bn, depending on the final engine specifications.

As far as the rest of the leading liner players are concerned, caution appears to have been exercised. Regarding COSCO group (which includes vessels ordered on behalf of its subsidiary Orient Overseas Container Line Ltd), only 18 of the 42 vessels in the orderbook are specified with alternative fuels, with the majority (of the 18) opting for methanol.

Singapore-based Ocean Network Express Pte Ltd and Pacific International Lines (Pte) Ltd have relatively fewer vessels on order, but they have chosen only alternative fuel “ready” vessels, which indicates the realisation that conversion costs in the future may still be costly. Of the major liner operators, Wan Hai Lines Ltd has 28 vessels in its orderbook which show no alternative fuel status in available shipping databases. This would appear to leave a question mark against significant additional costs at a future stage to potentially convert these vessels to an alternative fuel.

Of the world’s top liner operators, Zim Integrated Shipping Services Ltd is the only company to be taking all the vessels in its fleet renewal programme on long-term lease, rather than ordering them for its own account. However, all 30 vessels will be geared towards using alternative fuels, primarily focused on LNG, and to this end, Zim Integrated Shipping Services Ltd has also secured a 10-year deal with Shell NA LNG, LLC to supply fuel.

What can we deduce from the liner operator orderbook and fuel choices made so far?

- The current alternative fuel container fleet is very small, but with respect to the orderbook, there are over 200 units classed as being LNG capable and nearly 150 vessels as methanol dual-fuel. Production of sufficient fuel to meet the requirements of these vessels in the 2024 to 2027 period, will need to increase fairly rapidly.

- Some leading companies have not yet fully committed to the utilisation of a particular new fuel(s), and as such, conversion costs of vessels running with standard engines may be substantial in the future.

- The liner sector is in the middle of a defined downturn, and so servicing of debt attached to the construction of new vessels is critical.

- The commercial standard pricing of new alternative fuels remains unknown, as does the way in which liner operators will recover this cost from the market.

- At some stage, a number of elderly vessels in the container fleet (which utilise standard IFO 380 fuel oil) will seemingly become redundant, and there will be significant implications for independent tonnage providers (who, to date, have invested much less in newbuildings). A two-tier charter market may emerge in the new future.

- New, and at the moment, niche alternative fuel providers, are emerging to meet these growing requirements. How will this impact the market share of the current leading bunker suppliers? Will this have future insurance implications given the likely significant increases in costs?

- How will the experience of the liner market’s leading players affect decisions made by companies in the dry bulk and tanker sectors? It is notable that liner operators have taken up significant capacity at the major Asian shipyards.

The changing regulatory environment, as well as heightened demand from shippers, will alter the alternative fuels requirement of liner operators on an evolving basis. Infospectrum continues to closely monitor the impact of these changes on the strategies of leading players in the container market and this is reflected in our Analysts’ comprehensive appraisal of counterparty risk. In addition, Infospectrum has applied its consistent multi factor verification process to provide comprehensive Counterparty Risk Appraisal Reports and Ratings on a number of decarbonisation technologies and alternative fuel providers that support this transition. The risk associated with building an alternative fuels ecosystem (including product supply, distribution and other supporting infrastructure) suggests that players would be wise to adopt an integrated approach to risk assessment across the entire counterparty chain in keeping with the strategic, long-term nature of the investments and collaboration the sector will require.

*where appropriate, we have referred to key players using their brand names and or terms of convenience